Roth ira future value calculator

The historical Roth IRA contribution limits have steady increased since the Roth IRA was first introduced in 1997. Use our Roth IRA Conversion Calculator to compare estimated future values and taxes.

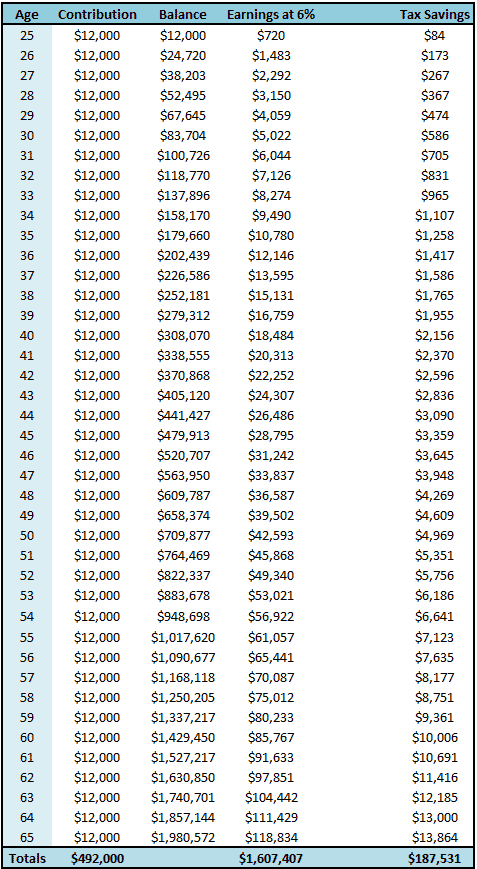

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Converting makes sense if you believe that the benefit from your money growing tax-free will be greater than the immediate cost of paying the taxes due at the time of the conversion.

. The Roth IRA is attractive for lower-income earners because you get to contribute lower-tax or no-tax money. See which accounts rank as the best. Decide Where to Open Your Roth IRA Account.

Converting it to a Roth. Those perks however come with a big asterisk. This calculator can help you figure out the present day value of a sum of money that will be received at a future date.

A Roth IRA is one of the best accounts for growing tax-free retirement savings and it takes just 15 minutes to open one. Roth IRA accounts offer tax-free growth on earnings and tax-free withdrawals in retirement. Roth total at retirement Total value in your Roth IRA at your retirement.

See an estimate of the taxes youd owe if you convert too. Use this future value calculator to estimate the future value of an account based on periodic investments hypothetical rates of return and investing time frame. Traditional IRA or call us at 866-855-5635 for help.

Determine if you are eligible to make the conversion. A Roth IRA may also be better if you expect tax rates or your tax rate to rise in the future increasing the value of the Roths tax-free withdrawals. Not FDIC Insured No Bank Guarantee May Lose Value.

There are three five-year rules that all Roth IRA owners must adhere to or pay taxes andor penalties. The Five-Year Rules for Roth IRAs. If you have an existing traditional IRA the same company can probably open a Roth IRA for you.

They are more likely to be referred to by their programs such as 401k the 457 plan or IRA etc. To take any distributions that include earnings that are tax free the Roth IRA must be opened for 5 tax years. There are income levels you must follow to determine if you can open a Roth IRA account.

But your patience is rewarded when its time to take. Steps to Convert a Traditional IRA to a Roth IRA. One of the main differences between a Roth IRA and a traditional IRA is the way contributions and withdrawals are taxed.

In the US today very rarely is the term DC plan used to refer to pension plans. Roth. Naturally it makes sense to take full.

Eligible tax-free distributions include those taken for death or disability after age 59-12 or for a first-time home purchase. Roth IRAs allow you to pay taxes on money going into your account and then all future withdrawals are tax-free. A Roth conversion is an optional decision to change part or all of an existing tax-deferred retirement plan such as a 401k or a traditional IRA to a Roth IRA.

Where you will live in retirement leaving money to others and required minimum distributions RMDs. Contributions are made with after-tax dollars. The accuracy of the analysis is dependent on the accuracy of such assumptions and projections.

Before converting a traditional 401k or IRA to a Roth 401k or IRA think about your future. The opposite of everything above is true for the Roth IRASavers get no upfront tax break. Traditional IRAs are the opposite.

Consider the costs of a conversion. Learn more about the differences between a Roth vs. In 2021 the Roth IRA contribution limit remains at 6000 with a 1000 catch-up contribution if you are 50 or over.

A Roth IRA is one of the best possible ways to invest for retirement and in fact many experts think its the single best retirement account to have. In no way are intended to predict or guarantee future inflation rates and investment performance of your investment. For more information or to do calculations involving each of them please visit the 401k Calculator IRA Calculator or Roth IRA Calculator.

Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping your Traditional IRA vs. How you would pay for it the 38 Medicare surtax and gains on company stock in a 401k. Earnings in a Roth account can be tax-free rather than tax-deferred.

Here are the three steps to convert your traditional IRA to a Roth IRA. First enter the payments future value and its discount rate. Keep in mind that while there are no income limitations to contribute to a Traditional IRA you are not eligible for a Roth IRA if your income level is too high.

Contributions to traditional IRA accounts may be tax-deductible are tax-free and future withdrawals are taxed like income. The first is that you must wait five years from when you. You cant contribute to a Roth directly if you exceed.

The money then compounds tax-free. Roth IRA contributions are made after-tax and future qualified withdrawals are tax-free. A Roth IRA conversion must be completed 60 days before the end of the tax year.

The Roth IRA also gives heirs tax-free. FV represents the future value or your goal amount 10000. Roth IRA contributions arent taxed because the contributions you make to them are usually made with after-tax money and you cant deduct them.

The Roth IRA Conversion Calculator shows you whether it might be worth converting your Traditional IRA to a Roth IRA. Almost all investment companies offer Roth IRA accounts.

Traditional Vs Roth Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculators

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Roth Ira Calculators

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Ira Kids Compound Interst Growth Of Roth Iras A Kid S Key To Future Wealth

Ira Calculator See What You Ll Have Saved Dqydj

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

What Is The Best Roth Ira Calculator District Capital Management

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

Traditional Vs Roth Ira Calculator

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal